The Crypto Vote: What the 2024 Presidential Race Means for Digital Currencies

Discover how political dynamics, bipartisan support, and presidential stances are sculpting the future of cryptocurrency investments. Join us for an in-depth analysis of these groundbreaking developments.

2024, the year of the election, is expected to bring unique dynamics to the financial landscape, where politicians will strive to present their best behavior in order to win over their potential voters. They are doing their best, as recent regulatory changes had a (positive) impact on the crypto industry.

In this article, we delve into the latest developments of regulatory intermingling and the prominent figures in this election theater and their stance on crypto. Let's explore the details.

Crypto Becoming Politically Relevant

Crypto has not only solidified its place in America’s financial future but also in the political arena, as highlighted during the ongoing 2024 presidential election. For the first time ever, Bitcoin, Ethereum, and cryptocurrency in general were topics of discussion in an American Presidential primary debate.

This political relevance is supported by a national survey titled "2024 Election: The Role of Crypto" conducted on behalf of Grayscale. The survey mentioned that 46% of voters indicated they are waiting for additional policies before investing in crypto, and half of younger voters are considering candidate positions on crypto before casting their votes.

Their main concerns are financial stability and concerns about inflation, which are identified as the most pressing issue in America today. Along with this, the role of store of value is driving voter interest in cryptocurrency.

According to the survey, "financial stability and being able to pay my bills" was chosen as the second most important value, ahead of family, patriotism, community engagement, and finding purpose.

The FIT21 Bill

Recently, on May 22, 2024, the U.S. House of Representatives passed the Financial Innovation and Technology for the 21st Century Act (FIT21), marking a significant legislative achievement for the crypto industry.

The bill would grant the CFTC, considered friendlier to the industry, more jurisdiction over the sector, helping to resolve conflicts over control between the SEC and the CFTC.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/dlnews/SNIR63WODZFWNLM5L7NEBFWDPI.jpg)

But some say there has never before been a spot commodities market that is regulated, and this bill is just handing this authority to the CFTC, hoping they are not like Gary Gensler (that was once head of CFTC).

FIT21 also introduces several key provisions that aim to provide clarity and safeguards for the crypto industry, such as: Token and app creators will be required to provide detailed disclosures about their projects, ensuring transparency for investors and users.

Also, exchanges and brokers will need to segregate customer funds and adhere to strict requirements to keep these funds safe.

On top of that, the legislation establishes clearer paths for token securities to trade on exchanges, in the hope for crypto innovation and revitalization of the industry, which is currently scared to do anything in the US without fear of punishment.

This legislation aims to establish clear rules for digital assets, which have long been sought by the crypto industry. Additionally, the legislation aims to clarify the definitions of what constitutes a crypto token as either a security or a commodity.

Reaction of Political and Industry Leaders

The bill has faced mixed reactions from political leaders. President Joe Biden and SEC Chair Gary Gensler have expressed opposition, with Gensler arguing that the bill is unnecessary and could undermine existing securities regulations.

Industry figures have hailed the bill's passage as a watershed moment for crypto in the United States, highlighting its potential to clarify regulations and foster innovation.

US House Passes Measure Overturning Controversial SEC Accounting Bulletin

Not long before the passage of FIT21, the bipartisan congressional repeal of SAB121 also highlighted the positive developments done in the American political landscape for crypto.

The SAB121, which was a measure aimed at overturning a controversial Securities and Exchange Commission (SEC) bulletin that established accounting standards for firms involved in custody of cryptocurrencies, was voted in favor by the US House of Representatives. The bulletin, published in 2022, faced criticism from the crypto industry for potentially hindering banks from safeguarding digital assets.

The vote resulted in a 228-182 majority, with mostly Republicans in favor of the measure and 21 Democrats voting for it.

The Importance of Bipartisan Support for Crypto

What we can learn from these recent voting sessions and developments is that the interest in a healthy crypto ecosystem will be crucial for both Republicans and Democrats if they want to win the votes of many young Americans and entrepreneurs.

Biden's Stance on Crypto and SEC Actions

The Biden administration has been viewed as openly hostile to the crypto industry. Gary Gensler, the chairman of the Securities and Exchange Commission (SEC) appointed by Biden, has been actively pursuing legal measures against various aspects of the crypto industry.

Biden's administration has shown a lack of support for cryptocurrencies throughout his term as president, and this is seen as an opportunity for Trump to position himself as the industry's ally

Trump's Views on Bitcoin and Crypto

Former President Donald Trump's views on cryptocurrency have evolved over time. In 2018, he criticized Bitcoin, calling it a "scam" and expressing concerns about its competition with the US dollar.

However, in recent statements, Trump has shown support for cryptocurrencies. He has acknowledged the growing popularity of crypto and has even embraced it himself.

Although Trump's understanding of crypto may be limited, his vocal support for the industry is noteworthy. He appears to be the first major party presidential candidate to embrace cryptocurrencies, which has resonated with some single-issue voters in the crypto community.

On top of that, Trump has embraced crypto donations for his upcoming campaign, and promised to pardon Ross Ulbricht, who was the founder of Silk Road and, according to some, popularized the use of Bitcoin in its early days.

Crypto and the future of bitcoin will be made in USA, I will support the right of self custody for the nation's 50 million crypto owners, I will keep Elizabeth Warren away from bitcoin, I will never allow CBDC, I will also stop Joe Biden's crusade to crush crypto. - Donald Trump

In Other News - SEC Approves 8 Ethereum ETFs

The U.S. Securities and Exchange Commission (SEC) has recently approved eight spot Ethereum ETFs from major issuers like BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton, which are names that ring a bell from not that long ago, when the Bitcoin ETF was approved.

What is interesting to see is that before this news came out, it seemed unlikely that the SEC would approve the Ethereum ETFs. However, the situation changed in an instant, not abnormal for crypto standards, but could indicate influence by political factors, especially since bipartisan House lawmakers had recently urged the SEC to approve these ETFs. What does this mean for the upcoming elections?

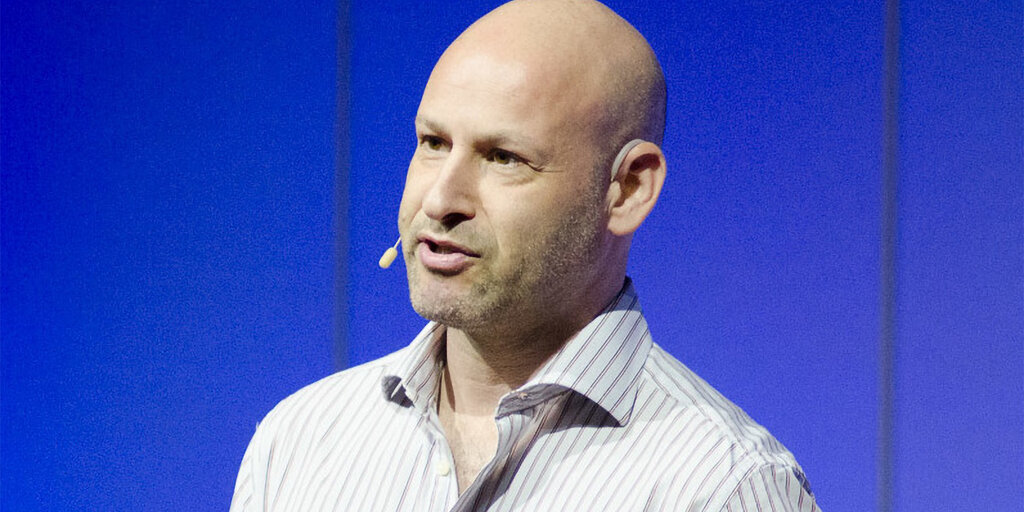

Consensys CEO and Ethereum co-founder Joseph Lubin described the recent approval of spot Ethereum ETFs by the U.S. Securities and Exchange Commission (SEC) and the alignment of bipartisan support behind a crypto regulation bill as pivotal moments for the industry.

While all this dilly dallying is going on in front of the world stage, there are cases being dropped by the regulators of the "free" world on many of the industry players in crypto, such as Metamask, which received a wells notice.

The SEC has served ConsenSys with a Wells Notice, a formal document that indicates the agency's intent to possibly pursue legal action. The notice alleges that MetaMask, one of the most widely used cryptocurrency wallets, has been operating as an unlicensed broker-dealer.

Consensys Challenges SEC's Authority Over Ethereum

In response, Consensys, a major supporter of the Ethereum blockchain, is seeking a judicial declaration that Ether (ETH) is not a security, resting with a filing that argues that the SEC’s actions are not only unlawful but also pose a threat to the entire blockchain ecosystem.

The complaint from Consensys contains forceful language, asserting that the SEC's attempts to regulate ETH are illegal and jeopardize the functionality of blockchain technology.

The firm contends that such regulatory actions could "bring the use of crypto in the United States to a halt," effectively crippling what it describes as one of the internet's most significant innovations.

Conclusion

Looking ahead to the 2024 election, the diverse viewpoints expressed by presidential candidates on crypto-related topics will be interesting.

Donald Trump's views on cryptocurrency have evolved from skepticism to a more positive outlook, which could be part of his campaign, as could Biden's stance, as they both can contribute to a thriving crypto industry and embrace the potential benefits it offers.

As crypto enthusiasts around the world are watching the crypto industry closely, the FIT21 bill represents a critical step towards establishing a regulatory environment in the United States.

Connect with Bitfinity Network

Bitfinity Wallet | Bitfinity Network | Twitter | Telegram | Discord | Github

Comments ()