Smart Contracts, Scalability, and Security: Comparing Bitcoin and Ethereum in DeFi

Delve into the riveting rivalry between Bitcoin and Ethereum as they vie for dominance in the DeFi arena. Explore their unique approaches, ecosystems, and potential in this captivating comparison.

For as long as we have known it, the blockchain sector has been dominated by two main giants: Bitcoin and Ethereum. But, when it comes to matters pertaining to decentralized finance, these two giants have had quite different stances.

Ethereum, renowned for its native smart contract capabilities, has dominated this arena for years while Bitcoin lagged behind, until recently. Once limited to simple peer-to-peer transfers, the Bitcoin blockchain is now rising as a powerful contender in the DeFi arena, challenging Ethereum's long-standing dominance.

Join us as we take you through a direct comparison between the two in the race to dominate DeFi. We'll look at their ecosystems, architecture, and future potential. Can Bitcoin dethrone Ethereum as the top DeFi blockchain?

Let’s find out!

Ethereum’s DeFi Dominance🧩

Essentially, without Ethereum, the DeFi landscape might not exist as we know it today. Although many may argue that it all began with the introduction of the Bitcoin blockchain in 2009, Ethereum copied this design and went beyond being just a cryptocurrency.

In 2015, Ethereum introduced a blockchain that could support smart contracts, which facilitated the development of decentralized applications. With these applications, users could for the first time participate in a host of money activities like trading, lending, borrowing, and even the creation of new asset classes like NFTs. And this is what came to be defined as DeFi.

Since then, Ethereum has continued to dominate this arena. Fueled by events like the ‘DeFi Summer’ of 2020 and the 2022 Ethereum 2.0 upgrade aka ‘The Merge’ which changed its consensus mechanism from Proof-of-Work (PoW) to Proof-of-Stake (PoS), it had lacked a formidable challenger to its reign until recently…

The Rise of Bitcoin DeFi 🔗

Bitcoin’s initial role in DeFi was somewhat limited. The main reason being that from its foundational days it was designed primarily for transactions, hence lacking the complex smart contract functionality essential for DeFi.

But as they like to say, 'constraints can foster innovation'. This limitation drove developers to think beyond and come up with solutions, and true to their efforts several were found. One of them was Layer 2 solutions.

As we have mentioned on different occasions, Layer 2 solutions are protocols built on top of the Bitcoin base layer to process transactions off-chain and only utilize its security for the final settlements. Being among the first strides in improving Bitcoin’s utility in DeFi, they come in different shapes such as rollups, sidechains such as Bitfinity itself.

The other solution was upgrades to its base layer. Up to date, the most notable upgrades are the 2017 SegWit upgrade and the 2021 Taproot upgrade, which enabled Schnorr Signatures.

While you can read about them in our previous articles, what is evident is that these Layer 2 solutions and upgrades are not just replicating Ethereum's DeFi on Bitcoin; they're forging new paths, leveraging Bitcoin's unique aspects to make it a key contender in this race. For the years they have been around, DeFi on Bitcoin has seen a tremendous rise like never before.

So, if Bitcoin has grown to be a key contender in this race, then let’s see how the two horses fare in the race…

Bitcoin vs. Ethereum in the DeFi Space

To effectively compare the two blockchains, we will look at their approaches to different aspects in DeFi based on their underlying architecture and their ecosystems.

Smart Contracts Capabilities

As we know; Smart contracts are computer programs that automatically execute an agreement when predetermined conditions are met.

Therefore, it is of no doubt that the flexibility of DeFi is based on the creation and implementation of these smart contracts.

🔗On Bitcoin, smart contracts are limited to simple conditional transactions due to its programming language, Script. A scripting language which is kept intentionally simple to ensure security of the network.

However, through upgrades Bitcoin has expanded its smart contract capabilities to incorporate more DeFi activities.

🧩On the other hand, Ethereum has native support for smart contracts. This is made possible by its programming language, Solidity. A coding language that allows for the creation of a diverse range of smart contracts for simple transactions to complex decentralized applications directly on the network.

Speed and Scalability

🔗By its original design, Bitcoin confirms a transaction with a block time of approximately 10 minutes and can process approximately seven transactions per second (TPS) if the network is not congested.

However, through the 2017 SegWit upgrade and Layer 2 solutions like the Lightning Network, it can now process more transactions even at lower costs, but the block creation time still remains.

🧩Scalability has also been a major problem in Ethereum given its original design can handle 20 to 30 TPS. During periods of network congestion, users have been forced to wait for long periods and even pay high gas fees. In a similar way, it has been forced to upgrade, for instance to the latest Ethereum 2.0, which aims to address these problems through sharding, which is still an ongoing implementation.

In addition, several Layer 2 solutions have been developed in the network to make DeFi services more fast and affordable.

Security

🔗Bitcoin's security model, based on its proof-of-work consensus mechanism, offers strong protection against attacks. Its scripting language's simplicity also reduces the risk of smart contract vulnerabilities, enhancing its appeal in the DeFi sector.

In addition, solutions like Layer 2, although operating separately, still cling to its base layer security for final settlements.

🧩As we have seen, Ethereum offers a more flexible environment for DeFi courtesy of its Turing-complete language, Solidity. However, this flexibility increases the risk of bugs and exploits in smart contracts such as the famous 2016 reentrancy attacks on The DAO.

Ecosystem

🔗Although still in the developing stage, the Bitcoin DeFi ecosystem is growing at a higher rate. Through layers, we now have decentralized exchanges, lending, borrowing, and staking platforms on the Bitcoin network.

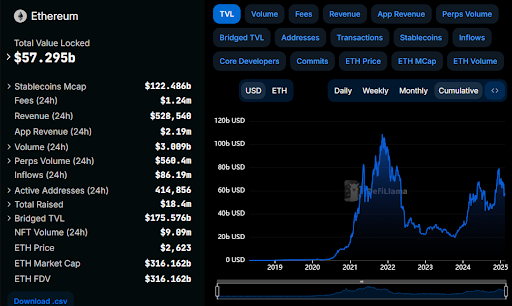

🧩Being a pioneer in this space, Ethereum’s DeFi ecosystem is vast and well established with the top DeFi protocols. Characterized by decentralized exchanges like Uniswap and major lending and liquid staking platforms like Aave, its DeFi TVL still leads the race.

Community and Culture

One of the key players in decentralized systems is the community. Therefore, it is important that we also look at their approaches to DeFi on the two blockchains.

🔗When it comes to the Bitcoin community, we have two sides. The first one is 'the maximalists' who believe that Bitcoin is the only blockchain that truly matters and its primary purpose is to serve as a peer-to-peer transaction system. Therefore, they oppose the coming of DeFi to Bitcoin with full force.

The other side is composed of those who are open to innovations in Bitcoin, but still maintain that the network’s core principles should not be compromised. That said, it now shows that the Bitcoin community tends to be more conservative and risk-averse, which is evident in its slower development pace and its focus on meaningful upgrades.

🧩 On the other side, the Ethereum community tends to be more experimental and risk-taking. After all, they view Ethereum as the building blockchain. This way, several upgrades and innovations are likely to be approved, which explains why DeFi has flourished on the network for all those years.

However, it is important to note that in some instances, experimentations on Ethereum have also slacked. For instance, Ethereum 2.0 comprised three main phases namely the Beacon Chain, The Merge, and Shard Chains. Only the first two have been implemented while Shard Chains is still a work in progress as we mentioned initially. This because there is too much economical value at risk, and a slight change could mean the loss of funds for many...

How is the Gap Between Bitcoin and Ethereum Bridged in DeFi?

Although the two blockchains take different approaches to DeFi, one of the growing areas of concern has been to bridge the gap between them.

One way to do this is by 'wrapping' Bitcoin assets and then availing them on the Ethereum network. For example, Wrapped Bitcoin (WBTC) allows BTC to be used as an ERC-20 token on the Ethereum blockchain.

The other solution is through Chain-key Bitcoin (ckBTC) is an ICRC-1-compliant token that is backed 1:1 by Bitcoin on the Internet Computer. It's a wrapped token that enables compatibility between different blockchains by allowing one token to be exchanged for another through a smart contract.

This can be done via the Bitfinity EVM, which brings Ethereum development experience on Bitcoin, while using the underlying technology of the Internet Computer.

With all that said, it is now quite clear that the race between Bitcoin and Ethereum in the DeFi arena is quite tight. The only question that remains is…

Can Bitcoin Overtake Ethereum in DeFi?

There is a growing belief among some industry insiders that DeFi on Bitcoin could potentially grow to be bigger than that on Ethereum. This perspective is fueled by recent developments in Bitcoin such as Ordinals (Non-fungible Tokens on Bitcoin) which ushered in the age of ‘building on Bitcoin’ and the anticipated OP_CAT implementation.

Back in 2023, 40% of Bitcoin open-source developers were focused on advancing Bitcoin L2s and scaling solutions to facilitate DeFi. Fast forward to 2024, over $88M was raised for infrastructure and growing adoption of Layer 2 solutions to diversify the Bitcoin DeFi ecosystem.

The #Bitcoin DeFi ecosystem is breaking new ground with projects like Babylon, Portal, and ALEX

— HC - Capital (@hc_capital) October 17, 2024

While #Ethereum has long been the go-to platform for DeFi, Bitcoin’s ecosystem is now drawing serious attention from top VCs like Paradigm and Binance Labs

With over $88M raised for… pic.twitter.com/FtN0lez1i9

Still, Bitcoin DeFi is in its early days, similar to where Ethereum was before its DeFi summer, which saw its TVL go over $100 billion in value. Currently, Ethereum's TVL on DeFi is sitting at around $57 billion. With a market cap of its circulating supply valued over $320 billion, this represents around 17% of its market cap locked in DeFi.

The current TVL locked in Bitcoin DeFi is around 6.5 billion. With a current market cap value of over 1.9 trillion, it means that only around 0.4% of its market cap is locked in DeFi yet it is already shaking the space. Therefore, if just 10% of its growing market cap were to be utilized in DeFi applications, it would absolutely outpace Ethereum DeFi.

Perhaps this is the real ‘flippening’ which was coined years ago. But this time instead of Ethereum overtaking Bitcoin in market cap as predicted it is being overthrown even where it dominates.

Connect with Bitfinity Network

Bitfinity Wallet | Bitfinity Network | Twitter | Telegram | Discord | Github

*Important Disclaimer: The information provided on this website is for general informational purposes only and should not be considered financial or investment advice. While we strive for accuracy, Bitfinity makes no representations or warranties regarding the completeness, accuracy, or reliability of the content and is not responsible for any errors or omissions, or for any outcomes resulting from the use of this information. The content may include opinions and forward-looking statements that involve risks and uncertainties, and any reliance on this information is at your own risk.

External links are provided for convenience, and we recommend verifying information before taking any action. Bitfinity is not liable for any direct or indirect losses or damages arising from the use of this information.

Comments ()