Is Bitcoin or Gold the Better Investment?

Is Bitcoin or Gold the better investment option? Here, we examine the evidence and speculate on what might offer the best return.

Are you tired of the age-old debate about investing in Bitcoin or gold?

Look no further, crypto enthusiasts! We at InfinitySwap are here to break down the pros and cons of each investment option and make a case for why Bitcoin is our choice, though you should always do your own research and never take anything we say as financial advice. So sit back, relax, and consider your own position as we explore the exciting world of Bitcoin and gold investments.

Who knows, by the end of this blog post, you might be ready to trade in your gold bullion for some digital gold!

A Brief Rundown on Bitcoin

Bitcoin, the first decentralized digital currency, was created in 2008 by Satoshi Nakamoto. Today, it has evolved into a revolutionary asset with a high potential for returns and a new form of digital store of value. Its digital nature makes it easy to transfer and store, unlike gold.

Goldman Sachs' Argument Against Bitcoin

Goldman Sachs argues that with inflation and recession concerns looming over the economy, gold is a safer place to put your money. But as a crypto enthusiast, you know that short-term dips in the market are just par for the course.

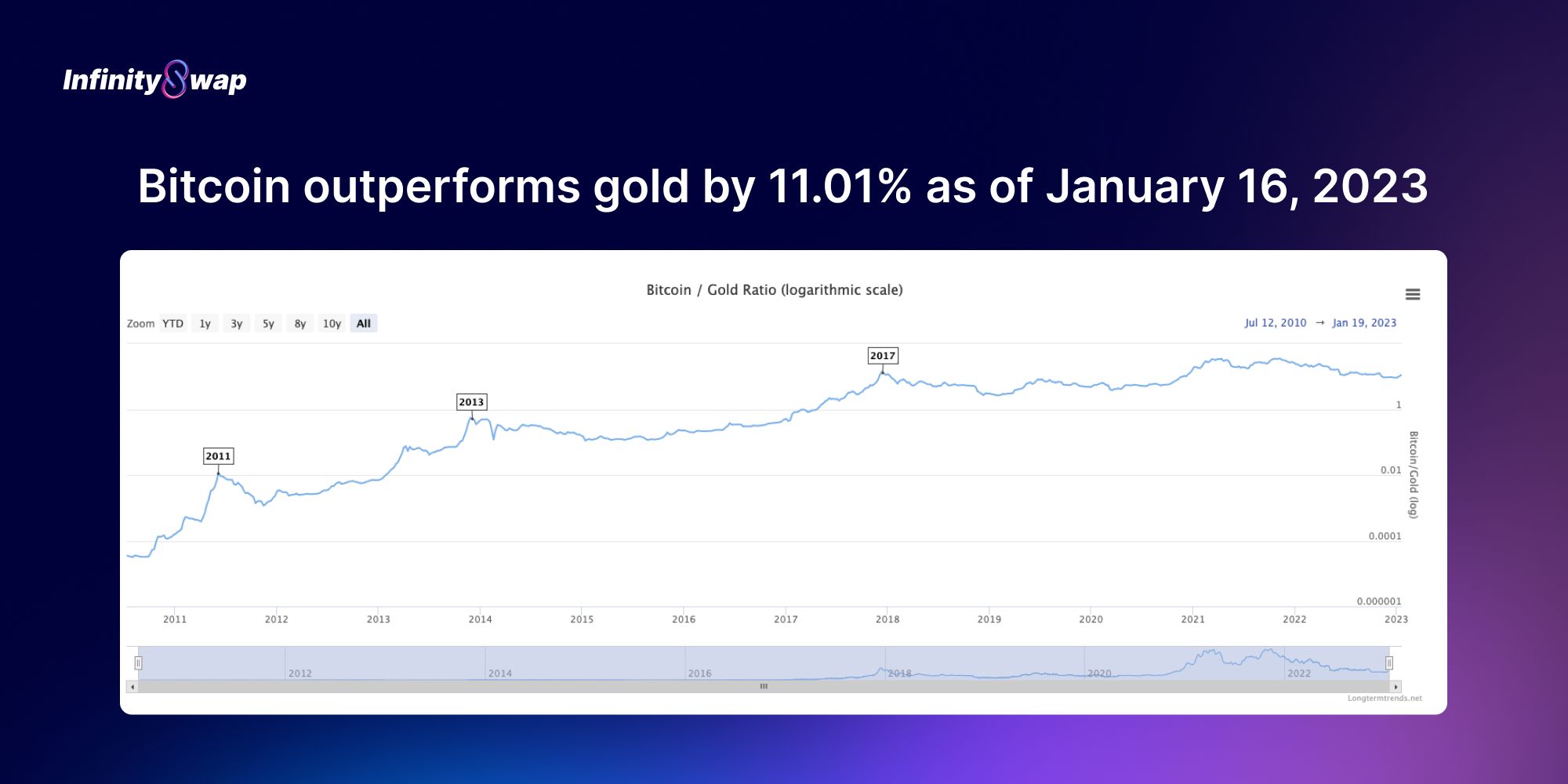

Here's the thing, when you look at the long-term performance of Bitcoin, it's hard to argue against it being a better investment than gold. From 2011 to 2021, Bitcoin delivered annualized returns of 230.6%, while gold's annualized return was just 1.5%. That's a whopping 229.1% difference in favor of Bitcoin.

Sure, the crypto market can be volatile, but over the past decade, it's proven to be a top-performing asset worldwide. Despite Goldman Sachs's opinion of Bitcoin, the currency has provided its users with an impressive return on investment.

What Does Bitcoin Have That Gold Doesn't?

Bitcoin offers many advantages over Gold, such as its digital nature, decentralization, and use cases, making it a more versatile and potentially profitable investment. Bitcoin's blockchain technology has the potential for various use cases, such as providing financial services to the unbanked population, creating a transparent supply chain, and more.

Bitcoin has shown a higher return on investment than Gold in the long run. As a crypto enthusiast, it's hard to look past the value inherent in Bitcoin.

Conclusion

If you're interested in investing in cryptocurrency, it's important to research the pros and cons of doing so. Here's the thing, we need to understand that the crypto market can be volatile, but you also know that the potential for high returns often outweighs the risks.

And with more and institutional investment, traditional finance firms, and even small businesses starting to invest in Bitcoin, it appears that the future of finance is digital. Many won't miss out on this opportunity to be what they consider to be the future of finance and will invest in Bitcoin.

So, what are you waiting for? Do your research and join the crypto revolution. Make sure to keep yourself informed about market developments, regulations, and new technologies.

The future is digital, and Bitcoin is at the forefront of it. Don't be left behind!

Connect with InfinitySwap

Twitter | Website | Telegram | Discord | Github

*Disclaimer: Note that cryptocurrencies can be volatile and speculation should not be construed as financial advice in any capacity. All opinions of the author are their own and do not necessarily reflect the opinions or position of InfinitySwap or its staff.

Comments ()