Ethereum's Shapella Upgrade

Discover the implications of the Shapella upgrade for Ethereum, which completed the proof-of-stake transition cycle. Learn about the Shanghai and Capella updates and how they enabled stakers to withdraw their staked Ether.

On April 12th, 2022, the Shapella upgrade went live and thereby completed the proof-of-stake transition cycle final for Ethereum. But what does this upgrade mean and what are its implications for the state of the network?

What was the Shapella update for Ethereum?

To clear things up, the name ‘Shapella’, is a ‘merge’ of the two seperate updates, namely the Shanghai and Capella updates. The end goal of these updates was to update the withdrawal function for the staked Ethereum.

The Shanghai update created a new transaction type that allowed stakers to withdraw validator balances, while the Capella update enabled the Beacon Chain to accept the withdrawal requests. So, via this implementation, ‘stake’ holders such as individual users and validators are able to withdraw their staked Ether (ETH), which was impossible since they deposited, starting from late 2020.

We can also differentiate two types of withdrawals, a partial and full. While accrued rewards or partial withdrawals are immediately possible, full withdrawals or validator exits are only possible when validators choose to shut down and withdraw all of their 32 ETH, needed to maintain their validator status.

Crunching the numbers

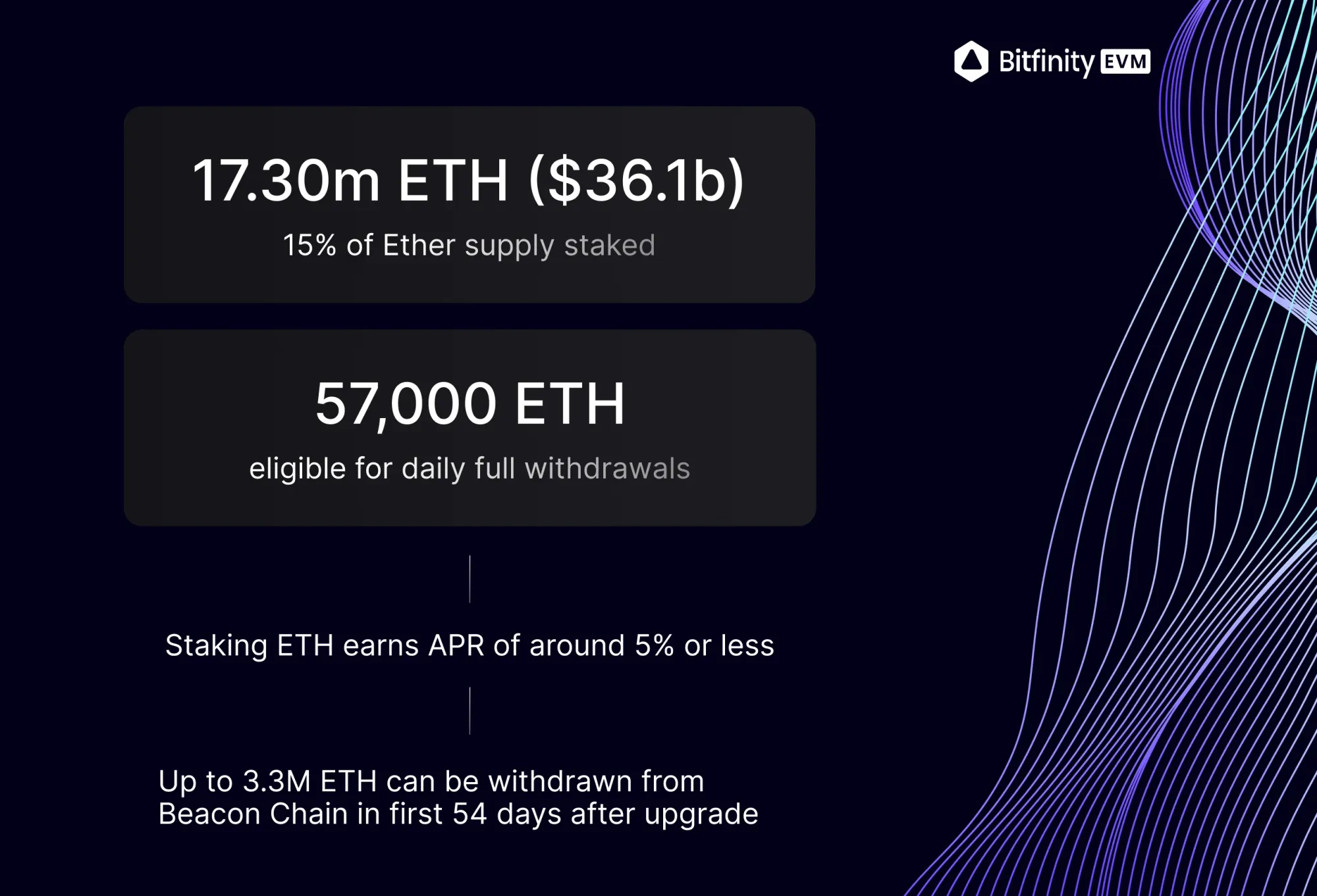

- Roughly 15% of the total Ether supply is deposited and staked, which accounts for 17.30m ETH ($36.1b)

- 57,000 ETH will be eligible for daily full withdrawals according to token.unlocks.

- Staking Ether will earn you an annual percentage rate (APR) of around 5% or less.

- Within the first 54 days after the upgrade, up to 3.3M ETH can be withdrawn from the Beacon Chain.

Finalization of Ethereum Proof-of-Stake

Blockchain-wise is the final transition and essence of the Shapella update, a great way to increase asset management flexibility. This is because the withdrawal of staked ETH has been made possible and users can easily tune in and out whenever they need. Yet another reason that Ethereum staking will attract new users looking for a more than standard return in a less risky way. All this could indicate a surge in staking deposits.

Impact Withdrawals on Ethereum

With high expectations of massive withdrawals, we see in reality, less than expected outflows of staked Ether. This could mean several things; such as, most of the deposits of Ethereum, were at a higher price, and many of the stakers are so deep underwater that they may choose not to sell at a loss.

Or, the intention of the user. While some users, as well as exchanges that were run into the ground, are experiencing ‘forced’ withdrawals, meaning they have no other choice. It could be that many of the withdrawals are not necessarily meant to sell and choose to rotate their Ether to other validators or staking providers.

Conclusion

The Shapella upgrade is a positive event in the evolution of Ethereum. As far as we are concerned the reduced risks of Ethereum could boost the baseline demand for ETH. The long-anticipated Shanghai and Capella upgrades went with a lot of speculation on price and worries around the resilience of the network, but turned out into a total non-event price and issue wise. This could mean that the update, which went without any issues, proves that the Ethereum network has become stronger and well established than ever. A good evolution for cryptocurrency and blockchain technology.

Connect with Bitfinity Network

Bitfinity Wallet |Bitfinity Network | Twitter | Website | Telegram | Discord | Github

*Disclaimer: While every effort is made on this website to provide accurate information, any opinions expressed or information disseminated do not necessarily reflect the views of Bitfinity itself.

Comments ()