From CEXs to DEXs: Bitfinity's First-in-Line Innovation Takes Center Stage

This report analyzes the collapse of centralized crypto exchanges like FTX and the rising alternative of decentralized exchanges (DEXs), exploring issues around transparency, regulation, liquidity and the future trend of both exchange models in 2024.

In a world where people and exchanges rely only on their reputation, choosing an exchange is a matter of reliability. Sadly for many, after many debacles indifference grew and hope was lost. But is there still hope out there, and where can a new herd be led? In this report we will discuss various aspects of decentralized exchanges, also known as DEXs, their solutions and unique product launches, and how to navigate through these different markets.

The Rise and Fall of Centralized Exchanges

When the crypto exchange FTX dramatically collapsed, many questions, uncertainties, and trust issues followed around the stability of crypto exchanges in general.

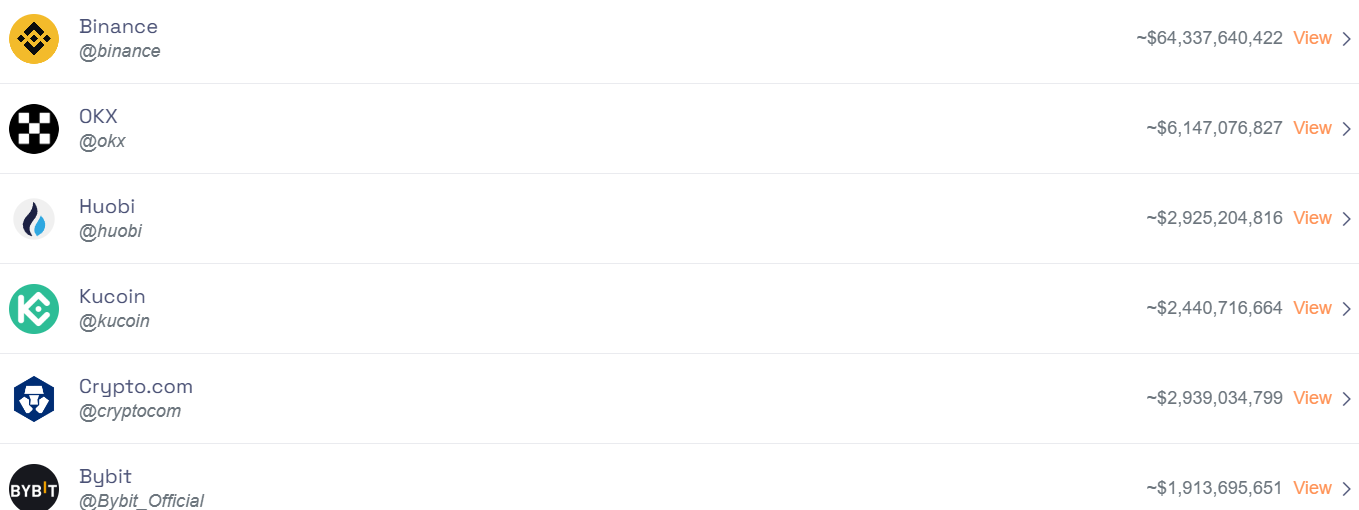

In the reaction that followed, with every exchange publishing their proof of reserves, stacked by loads of their own currencies and even sending funds back and forth in order to appear more liquid than they probably were, many industry insiders pointed to the lack of transparency and issues with their financial structures.

When asking ourselves what we learned about the notorious state of centralized crypto collapses, a cautionary tale of "stay strapped or get clapped" is more than certainly applicable.

The saying "If it is too good to be true, it usually is" means that the high and unrealistic returns of the exchange, such as the numbers Alameda Research or custodians are promising as a result of using excessive leverage, are flagged as potential red flags.

But still, a distinction has to be made. And looking at the bright side of things, we believe that these events and the ones that followed offer us three valuable lessons.

- The collapses of Exchanges/Brokers/Custodians were not fundamentally linked to crypto: The problems of the centralized parties involved and currently bankrupt could have and already have happened in any industry, but because the crypto niche is so “small,” the entire industry had to deal with the nuclear fallout that followed.

- Regulatory consequences that mean anything: The collapse ensured investors would ask themselves more questions about regulatory oversight within crypto. After endorsements of regulators and a seemingly good reputation, an increased understanding of regulatory status is now no guarantee for success.

- The great shift: The collapse of many has definitely pushed crypto from a niche interest to the mainstream, although for the wrong factors. There is no such thing as bad publicity.

Appointed CEO of cryptocurrency exchange FTX discusses negligence

Addressing Wash Trading in Crypto Exchanges

Another thing cryptocurrency platforms are known for is inflating their trades and volume. A little thing we call wash trading which is a problem. As numerous data explorers claim, a certain number of exchanges, are pumping up their volume and sending fake numbers into the world of crypto.

The Motivation for Decentralized Exchanges (DEXs)

But for crypto, there is always a counter movement. Why trust the people behind the trading desks with our hard-earned money if we can trust in numbers or code? It is just this narrative that started the explosive growth of DEXs, where speculators across the globe can swap without the interference of a centralized authority. Let’s take a look at some arguments for the decentralized exchange.

Censorship Resistance

As we mentioned, a core feature of DEXs is censorship resistance. While centralized exchanges are increasingly limiting user access and increasing requirements and background checks, DEXs remain accessible and functional in almost all situations, that is, if you are operating from a whitelisted country, your address is not flagged, or funds are not frozen, of course.

when defi apps started snitching on you, with links

— banteg (@bantg) August 12, 2022

2021-10-25 uniswap https://t.co/ym0wdNPJS6

2022-05-10 ren https://t.co/9588mTitKe

2022-06-29 balancer https://t.co/5V1FaxPUOn

2022-08-11 oasis https://t.co/GzkOQXXPb9

2022-08-12 aave https://t.co/vYY8MjqZ1p

(never) yearn, curve pic.twitter.com/1FkgVPnUqb

Transparency Defines Trust

Transparency is also a major reason why users trust DEXs over centralized exchanges. It is as easy to check the solvency of an decentralized exchange by simply visiting blockchain explorers and glancing at the TVL (Total Value Locked) or volumes traded.

Thanks to the transparency, informed users can review contract details, evaluate whether there is a backdoor function to withdraw user funds, and examine permissions to the system.

Although new entrants will never know the difference and still have to rely on trust, you really have to know what you are doing. But needless to say, these are unique advantages that centralized exchanges just cannot match.

As the demand for greater transparency grows, some decentralized exchanges are pursuing external audits, just as centralized exchanges work towards getting approved reserves. However, auditors are not always right.

.jpeg)

The 24/7 Nature of Crypto

The crypto market never sleeps and does not take a single holiday. It feels like every morning brings a new feature or asset released in the market. As a decentralized exchange grows, it will have to deal with crises and new problems to fix. So the code has more than its hands full.

But that is only the code - we see that after all crypto had to endure, all applications remained up and were offering the same services as they do now. Testing the infrastructure and being bulletproof.

Importance of Composability

Composability is another major key factor in DEX operations. By sharing the same block space as funds on layer one, it helps reduce the likelihood of DEXs becoming another centralized exchange. The benefit of being in a shared space is big because developers can build on top of it, and this is where the magic happens.

Centralized Exchanges vs. Decentralized Exchanges

Many users see the shift towards DEXs as a natural progression as they increasingly question why anyone would trade on a centralized exchange once user experience (UX) and liquidity issues are resolved.

The irony of trading governance tokens and native tokens of protocols on a centralized platform isn’t lost on crypto enthusiasts and so they move elsewhere.

Are Centralized Exchanges Aware of the Threat from DEXs?

Centralized exchanges are indeed aware of potential threats posed by DEXs. Quite a few have developed their own blockchains with DEXs to diversify away from their main business.

The growth of DEXs doesn't necessarily mean direct competition with centralized exchanges. Both have different use cases and it’s likely that both will coexist in the long term. It is an increasingly exciting prospect to see a business or complete industry running on all fronts, meaning centralized and decentralized.

Liquidity Issues

DEXs are an example of new markets, and a market is only as good as its liquidity, so the problem they face is tackling liquidity problems. Also, liquidity isn’t loyal, so if there is a need for liquidity, the same market makers that provide it on centralized exchanges will quickly come to the decentralized side. Industry producers will go where the users and retail are.

Attracting Retail Users to DEXs

The beauty of crypto is that it is almost all speculation, and industry producers will go where the users and retail are. Therefore, the essential question is: how can we make it better for the common retail user to do their finances with swaps of any kind on DEXs in the same familiar way as they are used to doing on centralized or traditional exchanges?

How do Decentralized Exchanges Approach Regulation?

Despite the fact that their original operational model is decentralized, exchanges are intelligently working to become more flexible. They're also working to start onboarding services and to capture broker-dealer licenses and registrations, mainly in the U.S., and if this is not possible, they move offshore or to countries that are more crypto-friendly.

Looking to the long term, these exchanges hope to convince regulators that their technology inherently self-regulates. And they are of the opinion that some of the issues regulators have, do not fall into their mandate and just go against their decentralized approach. So it may be that tax authorities have and will continue to have many issues with the current decentralized exchanges landscape, as we don’t yet have the technology easy tax extraction.

Decentralized Crypto Exchanges in 2024

The winner takes it all most of the time, and we see the same for the decentralized exchanges that distinguish themselves from the pack and lead in numbers. A few big players will likely control the industry.

Secondly, there will probably be new small exchanges that can capture upcoming trends and attract liquidity within a matter of days, putting them directly in the big game.

The landscape of new users will be much different, and exchanges will have to be even more adaptable in capturing these users. And where many centralized exchanges have to follow current narratives, they will anticipate new ones in a hybrid style and shift more towards a decentralized model.

Therefore its Bitfinity Network's goal is to create products that are simple for new users to understand and by presenting higher-level products than we are used to in the familiar DeFi space.

Conclusion

With the bad reputation centralized exchanges have brought upon us, we can say that the market is pushing us into the relatively unknown land of decentralized exchanges to conduct their business.

As DEXs continuously evolve and carry out new products, replicating all the functions that are known on their centralized counterparts and that mimic familiar crypto trading environments, Bitfinity Network aims to create a new paradigm that benefits all through greater usability, inclusiveness and cross-chain interconnectivity. This is the next-generation of DEX that users deserve. We are eager to look out for their upcoming developments and growing embeddedness in the cryptocurrency landscape.

Connect with Bitfinity Network

Bitfinity Wallet | Bitfinity Network | Twitter | Telegram | Discord | Github

*Important Disclaimer: While every effort is made on this website to provide accurate information, any opinions expressed or information disseminated do not necessarily reflect the views of Bitfinity itself. The information provided here is for general informational purposes only and should not be considered as financial advice.

Comments ()