BTC - ICP Integration and the Potential for Devs

Bitcoin integration on the Internet Computer is a feat of coding and engineering, a feature that supercharges the IC blockchain to make it the first true “World Computer.”

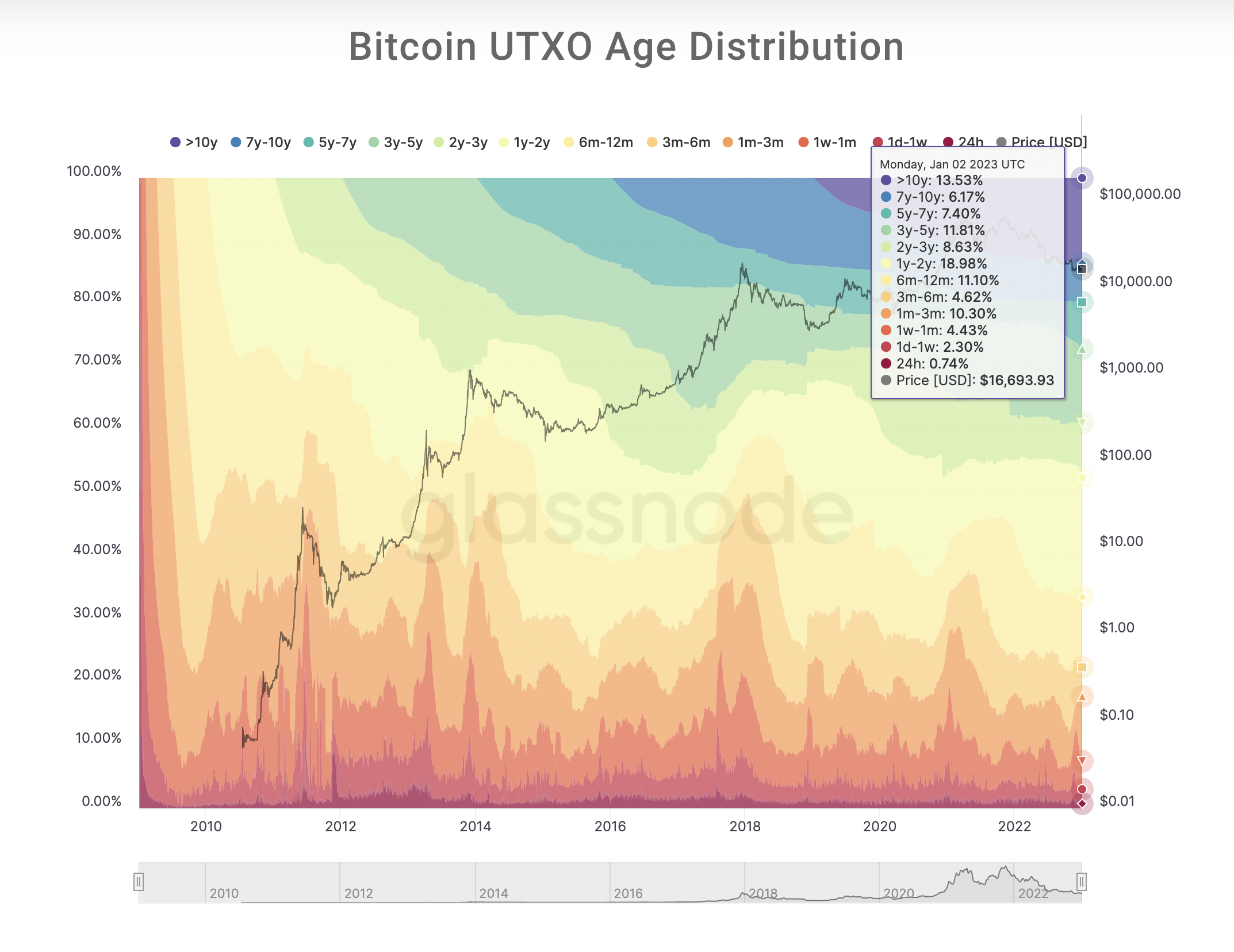

Bitcoin integration on the Internet Computer is a feat of coding and engineering, a feature that supercharges the IC blockchain to make it the first true “World Computer.” Secure, protocol-level integration means that there is no need for insecure bridges between the two blockchains, thus opening up a never before utilized pool of liquidity for DeFi. This is obviously significant, as Bitcoin is typically treated by holders as a locked investment—in fact, close to 65% of Bitcoin has not moved in over a year.

There is no doubt that this increased liquidity is worthy of attention; secure, fast interactions and collateralization protocols pave the way for a new era of trading. However, the BTC/ICP integration holds much more promise than just the potential of a DeFi boom for the entire crypto community. Thanks to the Internet Computer, Bitcoin can actually be utilized as currency, as it was at the beginning of its history.

$BTC as Usable Currency

Almost everyone in crypto has heard of the infamous “Bitcoin Pizza” story, when early adopter Laszlo Hanyecz bought a pizza for 10,000 $BTC back in 2010. And, of course, many people know about the Silk Road, a bustling marketplace that had a seedy reputation for selling illegal items but was also a tremendous demonstration of libertarian free market ideas. While drugs accounted for roughly 70% of the Silk Road’s transactions, rare collectibles such as books, jewelry, and art pieces also did notable volume, all under the safety of anonymity.

It has been nearly 13 years since the Bitcoin pizza incident and close to a decade since Silk Road was shut down. Since then, there have been many crypto projects that have sought to become the king of usable digital currency--that is, currency in the truest definition of the word. Stablecoins like $USDT (Tether) and $USDC (Circle) have risen to a certain place of dominance because of sheer conversion convenience, but the threat of de-pegging (when a stablecoin is no longer trading at a 1:1 ratio to the US dollar) is ever-present.

While it may seem laughable now to use Bitcoin to buy consumable items, it’s not crazy to consider using $BTC as a method of leveraging investment opportunities, especially with how sophisticated the crypto market has become since the early days.

Bitcoin Remains King

As the first cryptocurrency, Bitcoin has the most mainstream adoption over all other cryptos. There is a certain economic stability to Bitcoin that others simply don’t have, as it has become the de facto investment choice for institutional buyers (who continue to purchase Bitcoin during the current crypto winter). This factor holds more weight than it may appear upon first glance.

Not only are most cryptocurrencies currently down by an enormous percentage, but many have ceased to exist entirely. Although Bitcoin has also suffered from the market downturn, it is unanimously thought of as the only true ‘safe’ haven of value. This is evident when observing the tendency of OG traders and institutional investors alike to consolidate into $BTC during times of uncertainty.

Though Second in Marketcap, Ethereum is First Place for Opportunity Hunters

Ethereum, though slow and expensive to use compared to the Internet Computer Protocol, is the second choice of consolidation for long-term crypto players. The network’s established history and well-developed ecosystem are to credit for $ETH's reputation as the second safest investment after Bitcoin.

Even during the relentless drag downwards in 2022, Ethereum saw an overall transaction volume worth over $408.5m USD, a considerable chunk of it being NFT trading. Towards the end of last year, the NFT market saw a rise in trading volume, suggesting that investors are hunting for opportunities within the Ethereum ecosystem instead of simply buying and holding $ETH.

What This Means

With native Bitcoin integration on the IC, risk-averse buyers can be assured that they will be able to transact purely with $BTC. This opens up exciting bear market possibilities for visionary developers.

Just as Ethereum cultivated its reputation of ecosystem stability during the 2018 crypto winter, builders on the Internet Computer can leverage ICP’s superior technology now while the market is quiet to create bear-resistant products, backed by investor confidence in Bitcoin surviving this and all other future crypto winters.

So Long, Solana: Lessons from $SOL

One only needs to look at Solana’s recent struggles to realize what devastating effects a lack of investor confidence in a token can have, cascading from individual NFT projects to the entire blockchain ecosystem itself.

Solana, which was one of the biggest blockchains for NFT trading during the 2021 bull run, was actually showing signs of recovery in late 2022. Despite its many shortcomings (frequent network outages being a primary one), NFT volume was increasing towards the end of the year. It wasn’t until the FTX/Alameda meltdown that sentiment took a steep turn.

More than anything, even above actual network performance, the unclear future of $SOL price recovery seems to have pushed big-name NFT projects like y00ts and DeGods out of Solana and into Ethereum and Polygon (a Layer 2 to Ethereum). With Bitcoin, crypto investors are much more confident about its long-term survival.

BTC + ICP + You =?

By utilizing the IC’s lightning-fast speed and other technological advantages (such as the reverse gas model and the recently implemented HTTPS outcalls feature, which eliminates the need for oracle services like Chainlink), dev teams can attract value hunters who would rather buy and transact with Bitcoin instead of taking a risk on a different cryptocurrency.

Interested in building? You can get started with Bitcoin and the Internet Computer now. The DFINITY Foundation has a landing page full of resources so that devs can begin coding immediately, including video tutorials and more.

Connect with InfinitySwap

Twitter | Website | Telegram | Discord | Github

*Disclaimer: While every effort is made on this website to provide accurate information, any opinions expressed or information disseminated do not necessarily reflect the views of InfinitySwap itself.

Comments ()