Bitfinity and Beyond: DEX's, DeFi, and Stablecoins Explored

Discover the Bitfinity ecosystem in the first edition of exploring our partners in this dynamic and rapidly evolving space built on the Bitfinity EVM, enabling DeFi, NFTs, and more on the Bitcoin blockchain.

Today we are going to discuss the Bitfinity ecosystem that starts, of course, with the first EVM that uses chain fusion technology: the Bitfinity EVM. But it doesn't end here; it goes 'beyond'.

With different protocols and platforms that try to establish DeFi and define the foundational layer that Bitcoin is becoming, this first article delves into the unique features and offerings of each platform that is a part of the Bitfinity ecosystem. Let's start with the first main projects that comprise this growing ecosystem...

Bitfinity & DeFi 🫶

By now, we all know that Bitfinity wants to enable the groundwork for connecting smart contract capabilities to the Bitcoin blockchain, with all the features that it provides.

For this, we need protocols that want to provide these solutions and tackle the problems we are still facing in these early stages of groundwork. Let's take a look at some projects that tackle these important questions and 'inch' their way forward in the Bitfinity ecosystem.

Sonic 🤝

Sonic is a DeFi hub built on the Internet Computer that wants to leverage its unlimited scalability, cross-chain capabilities, and web-scale user experience, which Bitfinity also caters to. It is composed of a collection of DeFi protocols, enabling users to swap, issue, and trade their tokens and earn rewards by providing liquidity.

The Sonic hub also has well-documented APIs for teams that want to integrate their products within its ecosystem.

Me3 🤝

Me3 is another platform with products and tools for DeFi, GameFi, and Gamified Staking. Me3 offers the following products for this:

- Hype Pool, a DeFi staking platform where players stake tokens and participate in social actions to earn game-winning points for their team. Game topics can include blockchain projects, world events, esports teams, and more.

- Yield Battle, which is a comprehensive DeFi gamified staking platform that introduces staking mechanics that enable players to win rewards for correct predictions and earn points that enable them exclusive access to gameplay across other Me3 portfolio products.

IronChain Bank 🤝

IronChain Bank is also a DeFi platform powered by the Bitcoin Virtual Machine Network that is in the Bitfinity ecosystem and has a model which is based on ZK rollup technology.

Its made up of several features, but as of now, only staking, a launchpad, and their DEX are operational, while others like the bridge, lending and borrowing, swap, and faucet are 'coming soon'.

At IronChain Bank, staking can be done through bitcoin, where you earn real yield in the form of BTC. The IronDEX, on the other hand, is designed specifically for BRC-20 tokens, enabling transactions and liquidity provision.

Rivo 🤝

Rivo is a platform that aims to simplify access to DeFi products by availing them through a single interface as it merges a portfolio tracker, facilitates swaps, deposits, and withdrawals across any EVM network.

It also lets their users invest in high-performance yield marketplaces and pay for gas with stables you have on your balance.

BitFuge 🤝

BitFuge is also committed to building essential infrastructure to facilitate DeFi in the Bitcoin ecosystem. Currently, the platform has provided details of two main products it aims to launch: a decentralized exchange and an interoperable bridge to facilitate cross-chain operations with EVM and non-EVM chains.

Segment Finance 🤝

Segment Finance is a non-custodial, multi-chain lending and borrowing platform for BTCFi. Within its platform, users can access a diverse array of money markets, deep liquidity, and secure competitive yields for both lending and borrowing their blue-chip assets while accruing points.

As we mentioned earlier, the platform takes a multi-chain approach and is currently operational on six mainnets and three testnets. Check out more of their future milestones in this roadmap.

Pell 🤝

Pell is a BTC restaking network built on a multi-layered architecture for a wide range of Bitcoin protocols, applications, and infrastructure.

The network aggregates native BTC Stake and its Liquid Staking Derivatives (LSD) services to allow stakers to choose to validate built upon its network ecosystem and still promises more in the coming days. Check out the role of it in our article here.👇

Swell 🤝

After Pell, comes Swell, which provides users with a non-custodial means of liquid staking and restaking via transferable ERC-20 tokens (swETH and rswETH).

More importantly, the platform also supports swBTC Liquid Restaking Vault, which uses swBTC to offer liquidity for users who want to stake their wrapped Bitcoin - WBTC.

Bitfinity & DEXs 🫶

If we want to facilitate permissionless financial transactions, we have to be able to swap and exchange one token for another. This is where decentralized exchanges come in. In the extensive ecosystem of Bitfinity, there are a few DEXs as well, such as:

Demex 🤝

Decentralized Mercantile Exchange, or Demex, is a cross-chain platform designed to cater to all decentralized exchange needs from spot, perpetuals, and futures markets, as well as cross-chain money markets.

It uses the Tendermint consensus mechanism, which ensures that it remains fully decentralized, resistant to maximal extractable value (MEV), and operates fairly.

MEV refers to the profits that miners or validators can earn through their ability to manipulate the order of transactions in a blockchain block, as explained further in this article.👇

IceCreamSwap 🤝

As a DEX, IceCreamSwap offers functions such as swap, liquidity, farm, staking, bridge, info, and launchpad. Users can earn passive income by providing liquidity, farming, or staking.

These earnings are collected from trading fees for liquidity providers, while those in liquidity farms earn ICE tokens (the native token) additionally. For bridging, users can hop between numerous chains all thanks to its audited smart contracts and built-in faucet, which provides users with native tokens automatically when they bridge to a new chain.

IceCreamSwap's AI DEX aggregator is a built-in and home-grown feature that employs algorithms and smart order routing techniques powered by AI. This aggregation of liquidity helps its users achieve better execution prices and reduced slippage.

Value 🤝

There is also 'value' in Value, which is a decentralized exchange with multichain compatibility for both EVM and non-EVM chains. For EVM chains, it can be deployed on Bitfinity ofcourse, Ethereum, Polygon, BNB Smart Chain, and Base.

The first notable feature is market data aggregation. Value continuously fetches and aggregates real-time prices, order book information, trading volumes, and liquidity from hundreds of asset markets and other DEXs to determine optimal trading routes.

To mitigate the impact of market volatility and miner extractable value (MEV) bot manipulation, Value allows users to divide their orders into smaller portions. Once a secure trade route is determined, it executes the transaction through smart contracts.

Symmetric 🤝

Symmetric is a project that operates as a decentralized exchange, automated market maker, and non-custodial portfolio manager across different chains.

The project aims to eliminate barriers to entry to DeFi for all by offering an approach different from that in other DEX/AMM projects. It uses separate logic and math for both pools and swaps, which allows for significant customization and flexibility.

As opposed to the traditional 50/50 pools, Symmetric introduces a variety of options for liquidity pools by granting the ability to adjust both weights of pools and the number of tokens. Here are some of the unique pool configurations available:

- Custom Weight Pools: Users can set up pools with custom weight ratios like 80/20 or other desired proportions.

- Multi-Asset Pools: Users can include up to 8 different assets in these pools.

- Composable Stable Pools: These pools allow for low slippage swaps on soft pegged or correlated assets, resulting in deeper liquidity and less price fluctuation on large swaps.

Zotto 🤝

Zotto is an application that provides tools for browsing, buying, and sniping newly created token pools on decentralized exchanges.

The application empowers users to create and manage bots for spot and perpetual trades. It also includes a section termed 'snipe,' which allows users to discover new meme coins and even create bots for the same.

DotSwap 🤝

DotSwap is a Bitcoin assets swap platform that offers fast token exchanges and provides a fully functioning automated market maker and liquidity pools. Since its introduction in 2023, the platform has evolved into three main versions:

V1 marked the mainnet launch, introducing BRC20 swaps, an off-chain sequencer, and liquid providers points system. V2 added atomic swaps, multisig liquidity pools, and a DAO governance model. V3, the current version, brought an upgrade to the multisig scheme, addition of a private key custodian, support for ARC20, multiple new wallets, and mobile devices.

BrownFi 🤝

Its core functionality is based on an elastic parameterization of limit order-book (PLOB), which is a model with two liquidity distribution shapes: rectangle and v-shape. The former is equivalent to a flat order book, while the latter is similar to the statistical liquidity distribution of legacy limit order books.

Bitfinity & NFTs & Stablecoins 🫶

On these exchanges that form one of the pillars of decentralized, permissionless finance on Bitcoin, we have NFT platforms and stablecoin-oriented protocols that want to make their name in this space as well. These include in the Bitfinity ecosystem...

coNFT 🤝

coNFT is an application that serves as a hub for NFT activities and offers its users a wide range of services. First, there is a name service where users can register to get a Web3 ID for their favorite ecosystem and also trade NFTs.

Second, coNFT incorporates an NFT dashboard which allows users to easily discover collections from different marketplaces, facilitated by its multi-chain support.

Third is the bestbuy algorithm, which helps users discover hidden gems in top-tier collections by filtering them out at a cost.

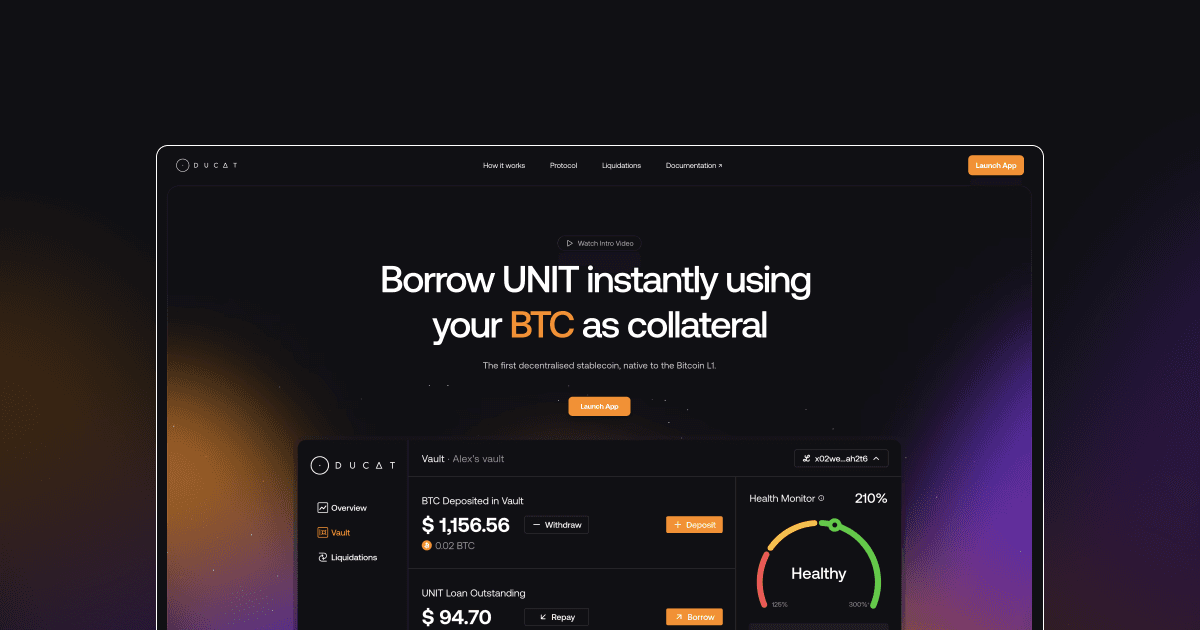

Ducat 🤝

Ducat is the protocol behind UNIT, which is touted as the first decentralized stablecoin native to the Bitcoin Layer 1. It acts as an escrow for users to borrow UNIT and use BTC as collateral, allowing them to obtain liquidity without selling their BTC.

UNIT is 160% collateralized with BTC and is soft-pegged to the USD at a ratio of 1.01-1.04 UNIT/USD.

If your vault's collateralization level falls below 135%, the protocol sells the vault to the first user willing to recapitalize that vault's BTC deficit, but you still keep your UNIT loan.

BitU 🤝

BitU Protocol is a 'CeDeFi' trading platform, which combines the best features and attributes of both centralized and decentralized finance.

The platform is powered by $BITU, a stablecoin which operates as an overcollateralized USD-pegged stablecoin. However, it differs from other stablecoins in that it is backed by BTC and other permitted assets rather than the US Treasury.

To learn more about stablecoins on the Bitcoin network, check out our article here👇

Conclusion

The Bitfinity ecosystem is growing and offers many things, as we've seen today. From decentralized exchanges and lending platforms to NFT marketplaces and stablecoins, the ecosystem is built on the foundation of Bitcoin and could use the helping hand of the Bitfinity EVM, which leverages chain fusion technology to enable smart contract capabilities on the Bitcoin blockchain.

As the ecosystem continues to grow and mature, it is clear that the future of decentralized finance on Bitcoin is bright. With the support of innovative projects like Sonic, Me3, IronChain Bank, Rivo, BitFuge, Segment Finance, Pell, Swell, and others, users can access a wide range of DeFi services and products, all while benefiting from the security and liquidity of the Bitcoin network.

See you in our next article on our ecosystem! 🦦

Connect with Bitfinity Network

Bitfinity Wallet | Bitfinity Network | Twitter | Telegram | Discord | Github

*Important Disclaimer: The information provided on this website is for general informational purposes only and should not be considered financial or investment advice. While we strive for accuracy, Bitfinity makes no representations or warranties regarding the completeness, accuracy, or reliability of the content and is not responsible for any errors or omissions, or for any outcomes resulting from the use of this information. The content may include opinions and forward-looking statements that involve risks and uncertainties, and any reliance on this information is at your own risk.

External links are provided for convenience, and we recommend verifying information before taking any action. Bitfinity is not liable for any direct or indirect losses or damages arising from the use of this information.

Comments ()