Bitcoin Meets Its Stable Match: Hello, Stablecoins!

Discover the transformative role of stablecoins on the Bitcoin blockchain! Explore their emergence, functionality, and the future of decentralized finance as we unveil the power of tokenization on the most trusted blockchain.

Over the years, the Bitcoin blockchain has undergone more than a metamorphosis - a series of transformations that have even let some dream of true decentralized finance on the biggest and most secure network. So lately, stablecoins have also emerged on this fertile ground...

Join us in this article as we explore the coming of stablecoins to the Bitcoin blockchain, their advantages, and potential challenges, and let's see what this all means when stringed together.

A Recap on Stablecoins

In recent years, stablecoins have seen significant growth and perhaps 'the' use case for blockchain technology for many participants worldwide.

With a market capitalization exceeding $170 billion across all blockchains, the not-so-stable surge emphasizes the increasing role of them in the digital space and as an entry point into the financial system. This viral spread goes across all blockchains, and Bitcoin hasn’t been left behind...

Stablecoins are digital currencies designed to have a relatively stable price. They serve as a bridge offering price stability between volatile cryptocurrencies and stable fiat currencies by being pegged to reserve assets like the US dollar.

Issuing Stablecoins on Bitcoin

Issuing stablecoins on the Bitcoin blockchain may come as a surprise to many, as we know it was known not that long ago as a base layer with only one native asset, namely BTC. However, various layered solutions are being built as we speak and many have been built in recent history.

Currently there are a few that enable the issuance of stablecoins on it such as Stacks, Liquid Network, and Rootstock (RSK).

All apply their smart contracts to make transactions within the Bitcoin network faster, more scalable, and cheaper. This makes it possible to maintain an own ecosystem on Bitcoin and support applications such as digital wallets, lending protocols, and decentralized exchanges (DEXs) which are essential for using and exchanging stablecoins.

Although the workings are important and perhaps interesting to learn about, we are not going to go into deep detail here. Today we are going to look at the several stablecoins that are already within the Bitcoin network.

USDA

Issued by Arkadiko on the Stacks layer, USDA is a decentralized stablecoin soft-pegged to the US Dollar. Users can mint USDA by depositing STX tokens as collateral in an Arkadiko Vault. A stablecoin which gives it utility with applications like Alex and Stackswap and facilitates stable transactions across the board.

Stablesats

The Lightning Network has also been utilized for the stablecoin space on Bitcoin as evidenced by Stablesats. Developed by Galoy, Stablesats aims to offer a solution for short-term volatility in the Bitcoin economy by offering users a synthetic USD account that they can use to hold 'dollar-equivalent' balances in their wallet.

USDRIF

USDRIF is a stablecoin within the Rootstock ecosystem, pegged to the US dollar, and backed by RIF tokens and other assets. It was launched in September 2023, to replace the previous Dollar on Chain stablecoin and is accessible via the RIF on Chain dApp or through multiple exchanges and on-ramps.

rDAI

rDAI, another stablecoin on the RSK layer, acted as an economical alternative to DAI, an Ethereum-based algorithmic stablecoin. By transferring DAI to RSK, through their bridge, the stablecoin could be traded at lower transaction fees, while maintaining a stable 1:1 peg to the US Dollar. But sadly the project stopped and nothing has ever been heard from it since.

These stablecoins aim to tackle similar problems such as hyperinflation, local currency volatility, and the high cost of sending money overseas. As all stablecoins are trying to facilitate transactions and provide stability in the world of hyperinflation.

If you notice, all the above stablecoin projects are pegged to a fiat currency, which is linked to the traditional banking system in ways we can only imagine. However, this seems to be taking another route with the emergence of Runes on Bitcoin.

Rise of Decentralized Stablecoins Via Runes

As we know, Runes was launched on Bitcoin to allow the network to create fungible tokens, mostly associated by many as 'memecoins'. But undoubtedly since its launch, the protocol has done perhaps more than it wished for.

With the new fungibility protocol, we have also witnessed the emergence of stablecoins that built their mechanisms on it.

NUSD

One notable stablecoin that has emerged on Runes is the NUSD- a stablecoin aimed to eliminate the need for centralized exchanges by being fully backed by BTC and operating on-chain. Its idea was first pitched by Arthur Hayes but gained more momentum after BAMK (Bamk of Nakamoto Dollar) came to implement it.

NUSD also offers additional benefits to users like earning yields simply by holding them, which promotes the same passive income stream without the need for active management or staking. Currently, it is backed by USDe but the plan is for it to be fully backed by BTC once the infrastructure allows for it.

Also impressive: $NUSD @bamkfi --

— Mark Jeffrey (@markjeffrey) June 1, 2024

A stablecoin -- implemented directly on #Bitcoin itself -- as both a BRC-20 and a Rune.$NUSD is backed 1:1 by Ethena USDe.

So it's "a Tether for Ethena on Bitcoin".

But unlike Tether (or USDC) you can actually SEE how much USDe backing… https://t.co/wQvFRmLjc4

UNIT

StableUnit is a synthetic stablecoin developed by the Ducat protocol that leverages Ordinals Inscriptions for smart contracts and the Taproot upgrade to turn BTC addresses into stablecoin vaults.

This therefore allows issuance of stablecoins on Bitcoin's base layer. UNIT will be issued as a Runes token making it compatible with all BTC wallets and will be 150% BTC-collateralized at issuance with its vaults being self-hosted.

1/ We’re excited to announce the Ducat Protocol - the first Bitcoin L1-native stablecoin on Runes. pic.twitter.com/cGib4RvlxE

— Ducat (@Ducatstable) April 24, 2024

Bitfinity and Stablecoins

Bitfinity could be positioned perfectly to run these experiments on, as they are at the forefront of enhancing blockchain interoperability and scalability. Utilizing the Internet Computer's Chain Key technology to develop a Layer 2 solution that supports high transaction throughput directly on-chain.

This integration allows cost-efficient transactions and could support all Runes experiments via the Runes bridge. It can offer a way to the already established ckUSDC—which is a pair of smart contracts that enable users and other smart contracts to send and receive USDC value almost instantaneously without incurring gas fees.

Kicked off #ICP's 3rd anniversary with a bang 🎉

— DFINITY (@dfinity) May 23, 2024

Tritium Milestone, powered by Chain Fusion, is now LIVE

✅ ckERC20 tokens & ckUSDC

✅ RPC canister for Ethereum & EVM integration

✅ Threshold ECDSA signing latency & throughput improvements

Explore: https://t.co/oZrPKo7CLF pic.twitter.com/EtNw4CQU71

Benefits of Stablecoins on the Bitcoin Blockchain

The issuance of stablecoin experiments on the Bitcoin blockchain could expand the network's functionality. This is done by allowing it to host many financial applications and yet again proving that the bitcoin blockchain is more than just a ledger for transactions but a base layer where an entire DeFi ecosystem can be built.

Additionally, unlike the big traditional stablecoins such as USDT and USDC, newer models could offer more transparency where users can verify reserves in real-time and avoid centralized exchanges which aligns more with Bitcoin's core principles of transparency and pure decentralization.

Although stablecoins are for now, only experiments, where many of them just haven't become relevant, new stablecoin models will probably be found, and with these new innovations significant risks and controversies come with...

Potential Challenges

The stablecoins, throughout their existence, have raised many security concerns. For example, many of these 'new' projects can be viewed as using complex mechanisms and perhaps remind some of the Terra-Luna scenarios, which left many REKT and traumatized.

Together with extreme volatility and stress from within the traditional finance system, it would also imply potential depegging events in these new stablecoins on Bitcoin, which are backed by these volatile assets.

This is evidenced by the struggle for stability experienced by USDT, DAI, and USDC when FTX and Silicon Valley Bank (SVB) collapsed.

Despite all these looming black swan events on a smaller scale, the creation of tokens and stablecoins on the Bitcoin blockchain has presented yet another innovative way to use the most trusted blockchain.

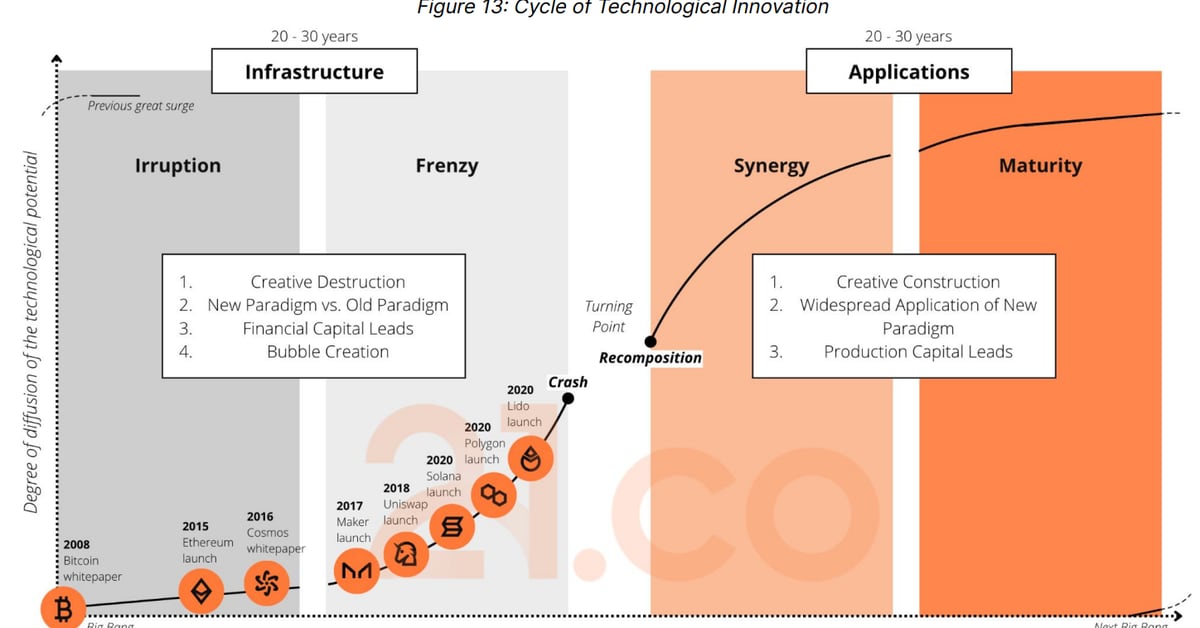

A look at the future shows potential shifts towards the creation of tokens on Bitcoin for more than just stablecoins, to tokenize everything...

Will Bitcoin's Future be Tokenized?

One of the biggest and most anticipated adoptions within the Bitcoin ecosystem is that of the broad tokenization sector, which is estimated to become a multi-trillion dollar industry over the next decade.

With this anticipation, almost every protocol or crypto project is in a rush to at least have a share of the cookie...

Where equity could represent a share of ownership in a corporation or organization with legal recognition, which is exactly what makes it a valuable sector. Therefore, a step towards tokenizing equity involves transforming ownership shares into digital tokens minted and transferred directly on the Bitcoin blockchain.

This could significantly streamline the process of buying, selling, and transferring ownership stakes. Reduced intermediaries such as lawyers and brokers would also make it more cost-effective for shareholders. On the other hand, companies would have access to a global pool of investors, potentially increasing the funds raised during capital drives and also allowing small investors to buy in without hefty minimum investments.

Legal Concerns

While technically feasible and potentially more efficient than traditional methods, these experimentations also face potential significant legal hurdles. Meaning that without state recognition and legal enforcement, tokenized equities could be deemed worthless or just plainly banned.

The Bitcoin blockchain can facilitate ownership proof, but the tokens do not hold real-world value unless the law recognizes this as proof. Additionally, stock exchanges and regulatory bodies may resist the shift to blockchain-based equities, if not done by themselves, as it could disrupt existing financial markets and undermine their centralized control.

As these discussions continue, the future of 'tokenizing everything' remains uncertain, and will be dependent on both the possibility to pull it off technically and legal and community consensus - that of Bitcoin itself.

Conclusion

The stable surge of stablecoins on every chain, and now on the Bitcoin blockchain, is facilitated by layer-2 solutions and platforms like Bitfinity. These developments expand Bitcoin's functionality, aligning more and more with its core principles of decentralization and transparency. This underlines the potential for a more stable and inclusive financial system built on Bitcoin.

As we navigate this new frontier, the success of Bitcoin-based stablecoins will depend on maintaining the innovative spirit of the ecosystem, community support and regulatory acceptance. It will also depend on leveraging Bitfinity and Chain Fusion to foster financial inclusivity and innovation on a global scale.

Connect with Bitfinity Network

Bitfinity Wallet | Bitfinity Network | Twitter | Telegram | Discord | Github

*Important Disclaimer: The information on this website is provided for general informational purposes only and should not be considered financial advice. While we strive for accuracy, Bitfinity does not endorse and is not responsible for any errors or omissions or for results obtained from the use of this information. Views expressed herein may not reflect those of Bitfinity. External links are provided for convenience and verification of information is recommended before taking any actions based on content found here.

Comments ()