Exploring the Bitcoin Ecosystem: A Comprehensive Overview

Bitcoin is no longer just digital gold. With layer 2 scaling, DeFi, NFTs, decentralized domains, and more, the Bitcoin ecosystem is expanding. Learn how Bitcoin is evolving...

Bitcoin now has: L2s, DeFi, NFTs, DeSo, DEXs, DAOs, AMMs, Games, Oracles, Meme Coins, Generative Art, and Domain Names. If you still think Bitcoin is a boomer chain, you're in for a very rude awakening! In this article, we take a closer look at the Bitcoin ecosystem that is keeping track with its time.

Bitcoin Layers

Bitcoin has been around the longest as a cryptocurrency, but its full potential has not yet been unlocked. This is largely due to insufficient infrastructure and developer tools. This is where layer 2 solutions come in, making it easier to build on the most proven and durable cryptocurrency.

Cons of Bitcoin's Base Layer

Bitcoin's base layer smart contract functionality is limited because it uses the non-Turing complete Script programming language. This restricts the types of smart contracts and dApps that can be built directly on Bitcoin.

While basic smart contracts like P2PKH, Multisig, HTLCs, and DLCs are possible, more complex dApps are not. In addition to these technical limitations, Bitcoin's base layer has come under scrutiny for the following issues:

- Transaction fees on the base layer are higher compared to Layer 2 solutions. There are no transaction fee reductions.

- You need to run a server to facilitate contracts using oracles. The oracle provider can't go offline or the contract breaks.

What is the current Bitcoin layer 2 ecosystem?

Some current Bitcoin layer 2 projects include:

- Lightning Network: Focused on payments, it is extremely fast and cheap but does not support complex smart contracts.

- Stacks: Uses a decentralized mechanism to transfer value between L1 and L2.

- Rootsock: Supports basic smart contracts and uses a federated model to move Bitcoin between layers.

- Liquid Network: Also uses a federated model and is its own network separate from Bitcoin.

The last two, Liquid and Rootstock are sidechains that allow more complex smart contracts while still leveraging Bitcoin's security.

By enabling smart contracts and complex payment logic, these systems expand what developers can build on Bitcoin beyond simple payments. This allows innovations in DeFi, prediction markets, tokenized assets, games and more.

DeFi on Bitcoin💸

Bitcoin's DeFi ecosystem is still in its early stages. Although there are gaps, the ecosystem is expanding to include more complex DeFi offerings like derivatives, stablecoins, lending protocols, and oracles.

- BTC Pegged Tokens- pTokens, WBTC, and others pegged to BTC provide liquidity between Bitcoin and Ethereum DeFi

- Decentralized Exchanges - Bisq enables P2P trading of BTC on Bitcoin's base layer. Also Thorchain the famous cross-chain lender can cross ftom Bitcoin to eight other chains.

- Infrastructure - MoonPay and QuikNode offer fiat on-ramps and developer APIs to build on Bitcoin

- Lending - Early lending protocols such as Money on Chain and BiFi allow borrowing against BTC

- Derivatives - Projects exploring BTC derivatives to allow leverage, hedging, etc.

- Oracles - Needed to bring external data to Bitcoin smart contracts

Establishing solid DeFi projects on Bitcoin could boost user confidence and enable the latest blockchain trends to happen on the original cryptocurrency blockchain, just like Satoshi envisioned it.

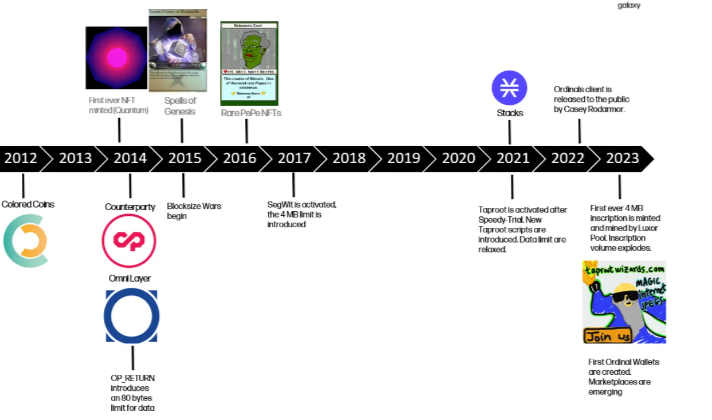

Bitcoin NFTs - Ordinals🆕

Ordinals are a numbering scheme for individual satoshis (smallest units of bitcoin) based on the order they are mined and sent on the Bitcoin blockchain. Casey Rodarmor, a former Bitcoin Core developer, launched a system called Ordinals and Inscriptions that allows attaching assets like NFTs to satoshis and sending them around on Bitcoin and Lightning networks.

What makes the new Bitcoin NFT protocols like Ordinals different?🖼️

Previous attempts at Bitcoin NFTs like Counterparty were limited because they stored the NFT metadata like images off-chain, so the on-chain NFT ownership token could be separated from the actual content.

New Bitcoin NFT protocols like Ordinals and Proof's in-chain NFTs solve this problem by storing the NFT metadata directly on the Bitcoin blockchain. This ensures the NFT ownership and content are indelibly linked on-chain. While excitement is partly due to their novelty as the first Bitcoin NFTs, storing NFT data on-chain has advantages for proving authenticity and preventing tampering.

Are you interested in learning how NFTs function on the Internet Computer blockchain? Read our informative article below to understand the basics of NFTs on Internet Computer and how they differ from NFTs on other chains.

Does Ordinals Violate Bitcoin's Purpose?🤔

Satoshi Nakamoto was against adding non-financial data to Bitcoin, wanting domain registration built as a separate system sharing mining with Bitcoin.

Many old-school cypherpunks argue Bitcoin should focus purely on money and payments. However, others see it as permissionless digital cash that can be used freely.

In any case, Ordinals-based NFT usage will likely be minimal - Bitcoin's financial utility and user base overshadow niche NFT interest. As Bitcoin gains value, NFT transactions will become prohibitively expensive regardless.

The biggest concern is Ordinals being used for illegal content like child pornography, which would create legal risks for everyone running Bitcoin nodes.

Some argue attaching content expands free speech protections for the blockchain. However, illegal material is not protected speech. Just one instance could jeopardize the blockchain's legal standing.

Bitcoin Name System (BNS)🌐

Decentralized domain names emerged early on with Bitcoin as one of the first non-financial use cases of blockchain technology. In 2011, Namecoin was created as a fork of Bitcoin to allow people to register decentralized domains by modifying Bitcoin's opcodes. Satoshi Nakamoto contributed ideas to Namecoin and was supportive of these types of experiments on Bitcoin's code.

How is BNS similar to NFT history?

Just as NFTs originated on Bitcoin through Counterparty before Ethereum, the Bitcoin Name System (BNS) as a decentralized naming protocol significantly predates Ethereum Name Service (ENS). The early .bit domains registered on BNS have historic value similar to some of the first NFTs minted on Bitcoin.

What are the Different Types of BTC Domains?

What are the different Bitcoin address formats?

There are currently 4 main types of Bitcoin addresses:

- Legacy - Starts with 1

- Nested Segwit - Starts with 3

- Native Segwit (bech32) - Starts with bc1

- Taproot - Starts with bc1p

The newer address formats like bech32 and Taproot are more efficient and cheaper to send bitcoin. Knowing the different formats is important to make sure you send to the right address type.

How do .BTC domains on Stacks work?

BTC.us offers .BTC domains registered on the Stacks layer 2 network. To register a .BTC domain on Stacks, you need to pay the registration fee in STX tokens and use a Stacks wallet address starting with ST1. The domains only work within the Stacks ecosystem.

What are Ordinals .BTC domains?

Ordinals .BTC domains are registered directly on the Bitcoin layer 1 blockchain. The domain metadata is stored in a JSON file inscription on the blockchain, similar to an NFT. This makes the domains provably scarce and usable as long as Bitcoin exists.

Bitcoin GameFi & SocialFi

GameFi on Bitcoin exists. Not only does Ethereum or the Internet Computer have play-to-earn games, but there are also a variety of games across mobile, arcade, puzzle, and casual genres. In this list, I will highlight some of the top Bitcoin games available today.

- Club Bitcoin: Solitaire - Classic solitaire game with bitcoin payouts

- Tetro Tiles - A tile-stacking puzzle game with bitcoin rewards

- Bitcoin Bounce - Earn bitcoin by bouncing along the blockchain

- Turbo 84 - Lane changing driving game with bitcoin rewards

- Bitcoin Snake - Classic snake game now rewarding sats

- Bitcoin Bay - Bubble shooter game with bitcoin payouts

- New Bitcoin City - The friend.tech of Bitcoin, as it offers casual, board, and strategy games on the web and mobile that run solely on the Bitcoin blockchain.

Conclusion

While adoption is currently limited, it’s clear that Bitcoin's ecosystem is still thriving and mirroring some of the same trends introduced on the Ethereum mainnet. Direct comparisons between Bitcoin and Ethereum cannot yet be made, but similarities continue to emerge.

Bitcoin's potential is evolving beyond just "digital gold" as its enhanced programmability opens up possibilities for DeFi, NFTs, tokens, games, and other dApps, while still benefiting from Bitcoin's security and network effects. This could be a promising direction that brings more utility to the Bitcoin ecosystem.

With increasing capital and talent entering crypto, there are opportunities to expand Bitcoin DeFi. Bitcoin's reputation for reliability could give it an advantage for DeFi over other chains. Growing DeFi may incentivize individuals and institutions to utilize their Bitcoin beyond payments.

Connect with Bitfinity Network

Bitfinity Wallet | Bitfinity Network | Twitter | Telegram | Discord | Github

*Important Disclaimer: While every effort is made on this website to provide accurate information, any opinions expressed or information disseminated do not necessarily reflect the views of Bitfinity itself. The information provided here is for general informational purposes only and should not be considered as financial advice.

Comments ()